Table of Contents

Owning a home is more than just having a place to live—it’s an investment in your future that symbolizes stability and success. Whether natural disasters, theft, or unforeseen accidents, having the right coverage can significantly improve your financial stability and peace of mind. In an uncertain world, being well-prepared with comprehensive insurance lets you focus on other essential aspects of life, knowing that your home and personal assets are secure.

Homeowners insurance might not be the most thrilling topic, but understanding its nuances is vital. Delving into the intricate details of a policy can help you identify potential gaps that may leave you vulnerable. Moreover, a well-structured insurance plan not only provides financial protection but could also contribute to personal reassurance—the peace of mind of knowing you’re prepared for any eventuality can be invaluable. This guide aims to equip you with the knowledge to make informed decisions about your insurance needs, ensuring your most significant investment remains safeguarded.

Key Takeaways

- Understanding the basics of homeowners insurance is crucial for protecting your most valuable investment.

- Every homeowner should be aware of the standard coverage options and the potential gaps in their policies.

- Proactively managing your policy can save money and prevent future headaches.

What Homeowners Insurance Typically Covers

Most homeowners insurance policies offer several layers of protection. Protecting that investment with homeowners insurance is crucial to safeguarding against the unexpected. They primarily cover the costs associated with repairing or rebuilding your home following damage caused by covered perils, including fires, windstorms, hail, and vandalism. Additionally, personal property protection helps to compensate for belongings inside the house, ranging from furniture to electronics, up to a specific limit. Liability coverage is arguably one of the most critical aspects, as it protects against legal responsibility if someone is injured on your property or if you accidentally damage another’s or another’s property. Furthermore, additional living expenses cover temporary housing and daily costs if damages from a covered loss render your home uninhabitable.

Unraveling the Myths: Common Misconceptions

Many homeowners operate under the assumption that their insurance covers all potential damages, which is different. For example, flood damages are commonly excluded from standard insurance policies. If your area is prone to flooding, you might need a separate policy to protect against such risks. Additionally, earthquakes and routine wear-and-tear often need to be covered. Understanding these nuances can prevent unpleasant shocks during claims, and it underscores the importance of reviewing your policy carefully to ensure that you adequately protect against the specific risks relevant to your geographical area and home type.

It’s also important to consider how car insurance interacts with your overall insurance strategy. Just as homeowners should be aware of the limitations of their home insurance policies, vehicle owners must understand what their car insurance covers. This includes liability, collision, comprehensive coverage, and any specific exclusions. Regularly reviewing your home and car insurance policies can help you identify gaps in coverage and ensure that you are fully protected against a wide range of risks.

Factors Influencing Your Premiums

Your insurance premiums are influenced by various factors, including your home’s home’s home’s location, the property’s-property’s property’s age, construction materials, and even your credit score. Homes in areas prone to natural disasters or with higher crime rates often see higher premiums due to increased risk. The home’s age and construction materials can also impact the insurance cost; older homes might be more costly due to outdated systems or materials more susceptible to damage. According to industry insights, improving your credit rating can lower these costs over time, as insurers often view consistent credit management as an indicator of reduced risk.

Strategies for Finding the Best Coverage

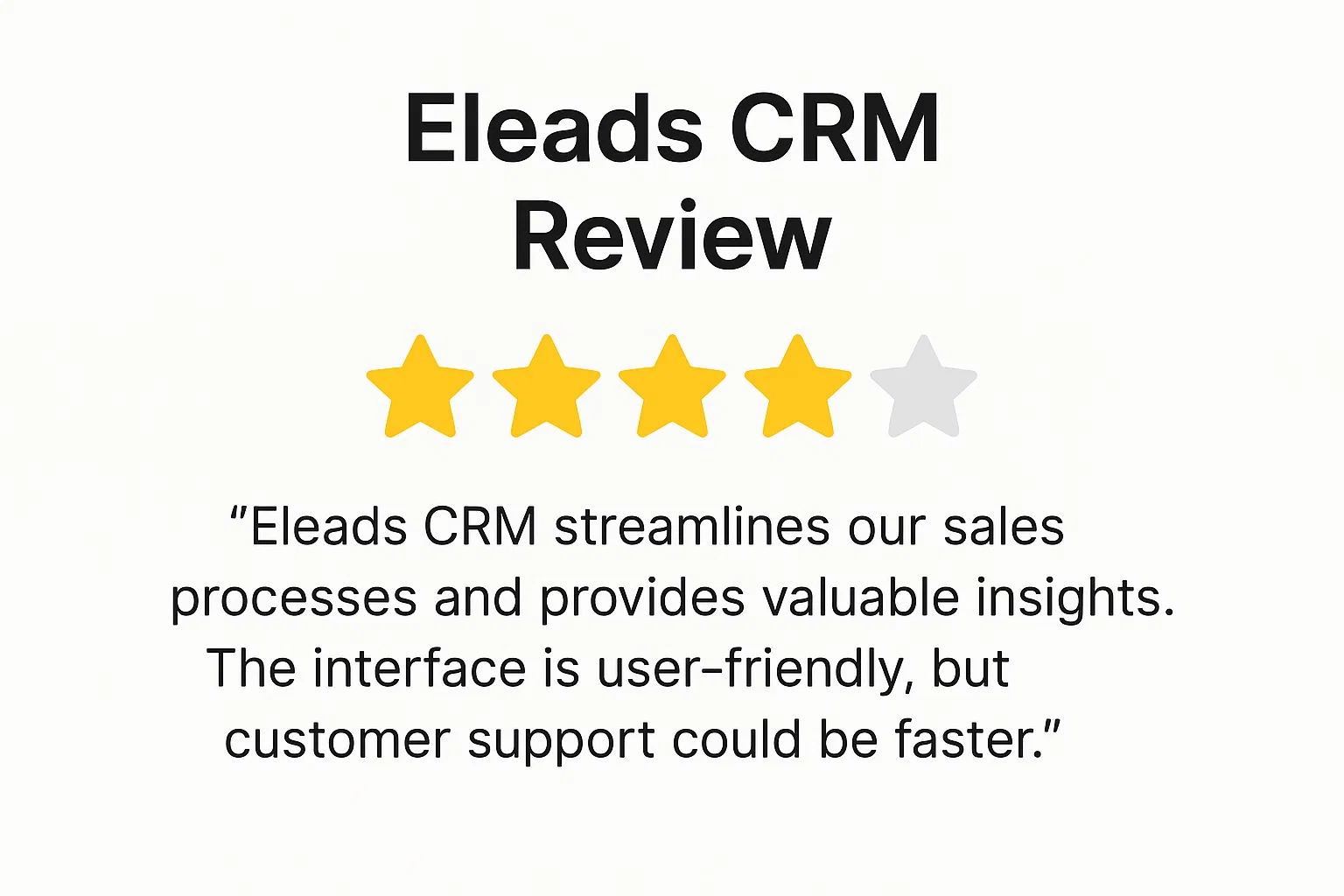

When seeking insurance, comparing quotes from different providers is essential in securing a policy that offers comprehensive coverage at a competitive price. Pay close attention to the coverage limits and any inclusions or exclusions unique to each policy. Consider bundling your home and auto insurance, as several companies offer discounts for such packages. Utilize online comparison tools that can streamline the process by simultaneously showcasing prices and coverage options across multiple providers. Please take advantage of customer reviews and ratings to gauge service satisfaction and reliability, ensuring you partner with an insurer who will stand by you when it matters most.

Also Read: Navigating the Landscape of Property and Casualty Insurance: A Comprehensive Guide

Hidden Risks and How to Address Them

Standard homeowners insurance plans might overlook obscure risks like earthquakes, sinking ground, or specific natural disasters. Add riders or endorsements to cover these perils to address these hidden threats effectively. Evaluating the geographic risks of your home is crucial, as is understanding the history of such events in your area. For example, reside in a region with a history of earthquakes or hurricanes. Looking into additional coverage options to bolster your primary policy can be a prudent step toward comprehensive protection.

When and How to Update Your Policy

Your insurance policy is not static. Updating it following significant life changes like home renovations, acquiring expensive items, or shifts in the housing market is essential. Renovations might increase your home’s value; you might need to increase your coverage limits. Similarly, purchasing valuable items such as jewelry or art might require additional protection beyond standard limits. Communicate these changes with your insurer promptly to ensure your policy accurately reflects your home and its contents, providing the best protection against unforeseen events.

The Importance of Documenting Your Belongings

Documenting your possessions ensures a speedy and accurate claims settlement if an unfortunate event occurs. Utilize home inventory apps or checklists to keep updated records of each valuable item, including photographs and receipts; this record advances your interests when dealing with potential claims and provides solid proof of ownership and value. Additionally, a well-maintained inventory can whisk you through the often tedious claims process, helping you identify whether your current coverage adequately protects all your possessions.

Navigating Claims: Steps to Take

Understanding the claims process is pivotal in ensuring you receive what you owe. Immediately report damages to your provider and ensure you document everything in detail—from photos to receipts to incident summaries. Maintaining thorough documentation lends strong support to any claim filed. Quick action and substantial documentation typically result in more efficient claims processing and timely settlement. Remember, insurance providers are more likely to resolve issues promptly and favorably when supplied with clear evidence outlining the extent and value of the loss.

In essence, managing homeowners insurance requires diligence and regular assessment. Staying informed and proactive can ensure your fortress is protected against adversity. By devoting time to understanding, optimizing understanding, and optimizing your coverage, you provide your home and yourself with robust protection that fosters peace of mind while enriching your investment.