In the age of digital transformation, the world of banking and financial services is changing rapidly with the joint of advanced technologies. The birth of E-wallets, mobile banking, and digital currencies are typical examples of how technology disrupts the traditional banking industry. As a result, banks and financial institutions worldwide are investing heavily in software development to keep up with the evolving landscape.

Unfortunately, banking and financial software development is not an easy path. It comes with challenges and obstacles that must be overcome to roll out genuinely high-quality, secure, and efficient software solutions.

What Is Banking and Financial Software?

This category, where specialized enterprise applications are designed, built, and used, is a significant part of the financial sector. The ultimate goal of banking and financial software is not just about automating processes, enhancing operational efficiency, ensuring regulatory compliance, and improving customer experience. It’s about shaping the economy.

Under this category, various software types are tailored to specific aspects of banking operations. These include core banking software for managing essential banking functions, document management software for storing and retrieving documents, administrative management software for overseeing administrative tasks, and customer service solutions for enhancing customer experience.

- Core Banking Software: This software type is the backbone of banking operational processes, managing essential banking functions such as transactions, accounts, loans, deposits, and customer information.

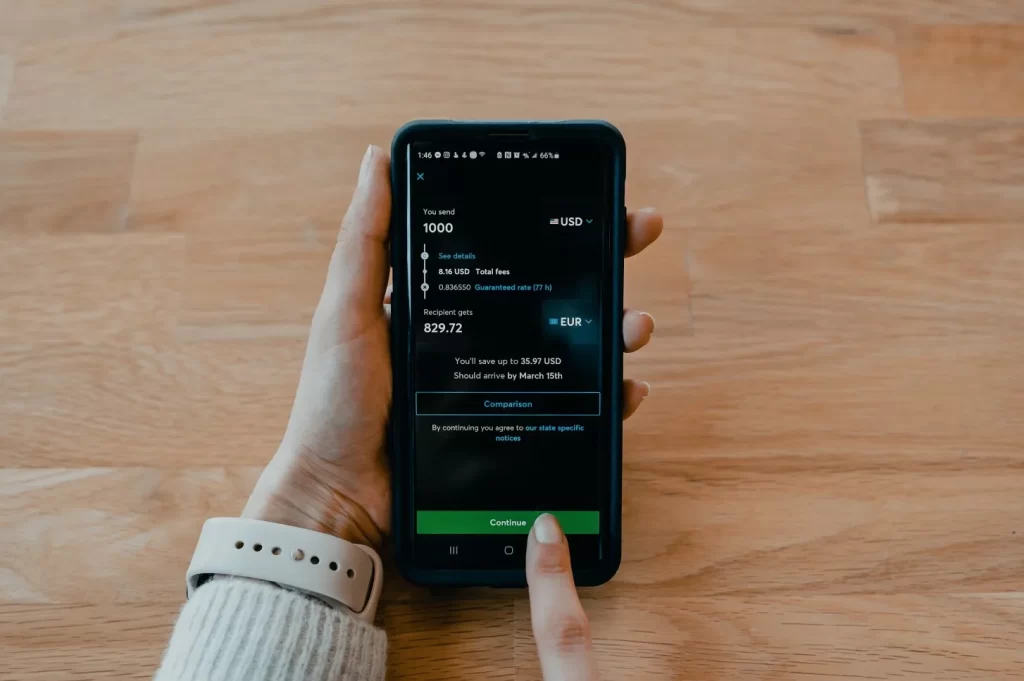

- Payment Processing Software: Payment processing solutions are created to facilitate secure and efficient payment transactions, including online payments, wire transfers, ACH payments, and mobile payments.

- Risk Management Software: These tools help banks and financial institutions identify, assess, and mitigate risks (E.g., credit risk, market risk, operational risk, and compliance risk.)

- Wealth Management Software: Wealth management software assists in managing high-net-worth clients’ assets, providing investment advice, portfolio management, financial planning, and performance monitoring.

- Anti-Money Laundering (AML) Software: AML software solutions help financial institutions detect and prevent money laundering activities by monitoring transactions, conducting due diligence, and flagging suspicious activities.

- Customer Relationship Management (CRM): CRM software enables banks to manage customer interactions, improve customer service, track leads, and personalize marketing efforts based on customer data.

- Accounting Systems: Such software is tasked to streamline financial processes by automating tasks like bookkeeping, budgeting, financial reporting, and tax compliance.

- Loan Origination Software: Loan origination software simplifies the loan approval process, from application intake to underwriting, approval, and disbursement of loans.

- Mobile Banking Apps: These are popular. Mobile banking applications enable customers to access banking services via smartphones or mobile devices, offering features like account management, fund transfers, bill payments, and mobile check deposits.

- Trading Platforms: Trading platforms cater to investment professionals and traders, providing real-time market data, trade execution capabilities, research tools, and analytics for trading stocks, commodities, currencies, and other financial instruments.

Remember that these are just a few examples of the diverse banking and financial software solutions available. As user needs become more complex, more banking and financial solutions will be developed with more advanced functionalities.

Challenges You’ll Face When Embarking on the Banking and Financial Software Development Journey

Building a banking app is ridden with obstacles and difficulties like any software engineering process. Time to list them all down:

Stringent Regulatory Compliance

The banking and financial sector is heavily regulated, with strict requirements and standards (for example, ISO 20022 for payments) to guarantee data security, customer privacy, and financial stability. Therefore, developing software that complies with complex regulations like GDPR, PCI DSS, and industry-specific laws can be challenging.

Data Security and Privacy

In the banking industry, maintaining the highest possible level of security and privacy is of utmost importance since you are handling a large volume of sensitive information and confidential data from customers and businesses. So, developing software for this sector must be watched closely for potential security vulnerabilities. Any data breaches can have serious consequences, including financial losses, legal actions, and damage to reputation.

Integration with Legacy Systems

Many banks and financial institutions still rely on decades-old legacy systems. This reality makes integrating with new software systems or solutions challenging without disrupting the existing infrastructure. Hence, developing new software poses a significant challenge, as it requires careful planning and execution to ensure seamless integration.

Cost and Resource Management

Banking and financial software engineering can be resource-intensive. The entire development process requires skilled professionals, infrastructure, and ongoing maintenance. Therefore, project managers and their teams must work out how to manage development costs and balance resource allocation.

Resiliency and Durability

Financial systems must be designed to withstand various challenges, such as cyberattacks, hardware failures, natural disasters, and economic downturns. However, this is also an obstacle to ensuring operational resiliency and durability in the face of unforeseen events. This involves implementing redundancy, failover mechanisms, and comprehensive disaster recovery plans.

Continuous Innovation and Adaptation

The financial industry is rapidly evolving, driven by technological advancements and changing customer expectations. Staying competitive in the banking industry and the market always requires a culture of continuous innovation, agility, and adaptability within the development team and in the development direction. Developers need to keep pace with the latest trends, technologies, and customer demands to deliver cutting-edge solutions.

Also Read: The Invaluable Advantages of System Integration Testing (SIT)

Testing and Quality Assurance

Quality assurance and testing are complex processes due to the high stakes involved. Banking and financial software must be thoroughly tested for functional requirements and security, performance, and user experience. This requires considerable time, effort, and resources to ensure that the software meets all necessary standards before deployment.

Scalability and Performance

As banking systems need to process large volumes of transactions and data daily, they need to be built with room for scalability and high performance. Your software should be able to accommodate growth and maintain stable performance under heavy loads, which is an essential consideration during software development. Developers need a well-crafted plan to make sure the software can handle increased usage without compromising its functionality and user experience.