Table of Contents

Purchasing a home overseas is an adventure that promises new experiences, investment rewards, and sometimes, even a new lifestyle. Yet, the path to buying international real estate can be complex, with numerous unknowns. Whether considering a retirement escape, a vacation haven, or a rental income property, understanding what lies ahead will make your journey smoother. For instance, if you are exploring vibrant markets like Costa Rica real estate, you need a strategic approach that minimizes surprises and maximizes peace of mind.

Ensuring that your overseas property purchase is stress-free requires more than just picking a beautiful destination; it hinges on navigating legal landscapes, optimizing financial decisions, and building a trustworthy local support network. From understanding country-specific ownership laws to factoring in hidden costs, each step demands careful attention. And with the proper preparation, you can secure your dream property abroad without unnecessary setbacks or risks.

International property laws differ dramatically from one region to another. Some countries have open-door policies for overseas buyers, while others impose restrictions or require complex legal processes. These differences become particularly pronounced in highly sought-after destinations. It’s vital to grasp both the letter of the law and the cultural nuances attached to property ownership to avoid inadvertent violations or delays.

Due diligence is your ultimate safeguard. Beyond legal research, real estate transactions overseas demand careful assessment of a property’s legitimacy, compliance, and risk profile. Enlisting credible local professionals ensures you uncover potential legal disputes, encumbrances, or discrepancies in ownership that might not be visible at first glance.

Understanding Local Laws and Regulations

Before you make any commitments, dedicate time to comprehensively researching the property ownership laws in your country of interest. Some nations, such as Thailand and the Philippines, restrict foreign ownership for certain property types or locations. Others may require you to purchase through a local corporation or enter a long-term lease agreement rather than ownership. In addition to ownership laws, familiarize yourself with the buying process, from contract negotiation to closing. When in doubt, working with a local real estate attorney is not merely a wise move—it’s often essential.

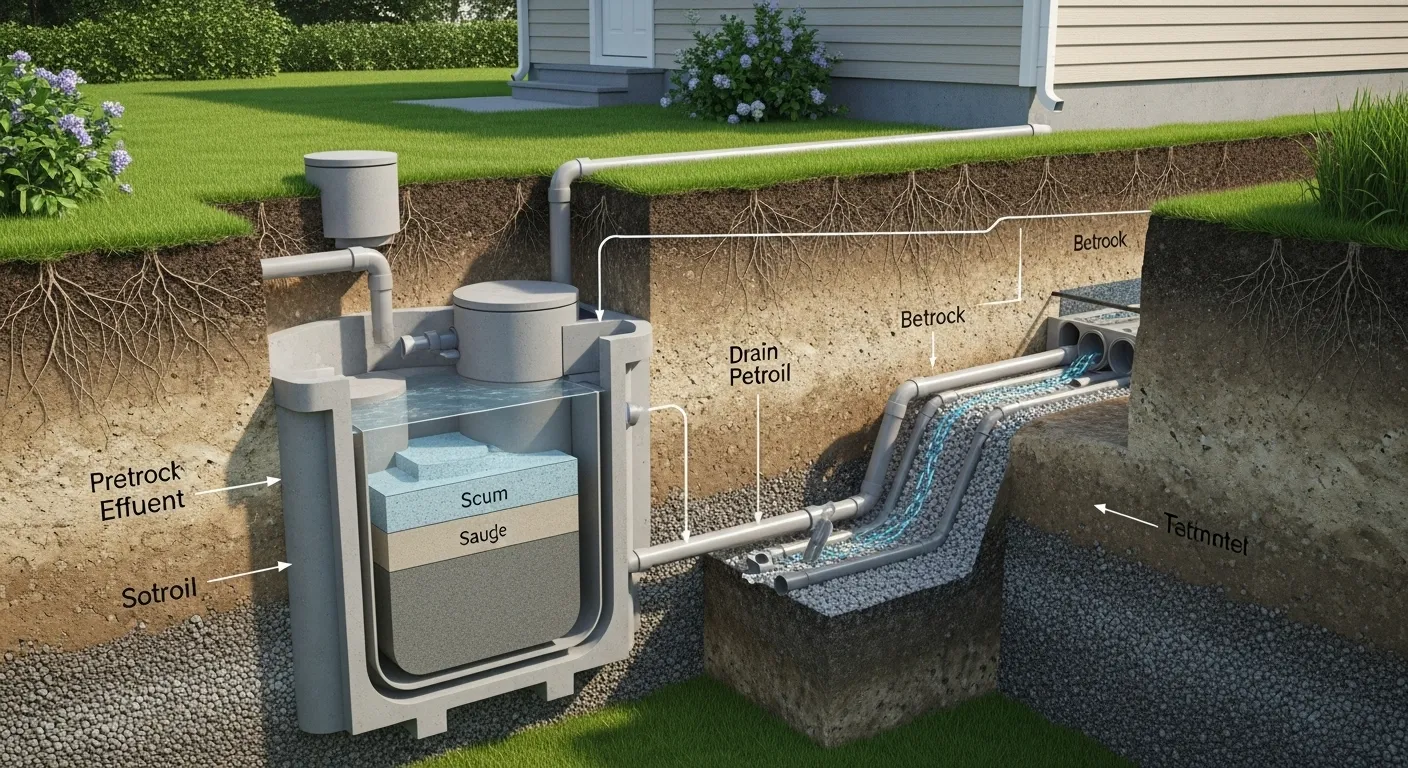

Conducting Thorough Due Diligence

International property buyers must rigorously authenticate every aspect of their intended investment. Begin by verifying the property’s land title and confirming the seller’s legal right to transact. Investigate whether there are any liens, unpaid taxes, or boundary disputes. Ensuring the property complies with local zoning and building regulations is just as important. A qualified local professional can handle title searches and background checks, and guide you through all requisite inspections. For further detailed information about international property law, consult this comprehensive guide from The New York Times Real Estate.

Securing Financing and Managing Currency Exchange

Financing an overseas property can be more challenging than buying in your home country. Many banks are hesitant to lend to foreign buyers, and if international mortgages are available, interest rates and requirements may be much stricter. As a result, some buyers opt to use cash or arrange financing through a home equity loan. In addition, fluctuating exchange rates can make a significant difference in your final outlay. An error in timing your currency exchange—or not locking in a favorable rate—can amount to thousands in extra costs. Working with a foreign exchange specialist is highly recommended to mitigate this risk. click here to read more about The Art of Choosing the Perfect Waterfront Property.

Assessing Hidden Costs and Taxes

Beyond the headline price, be alert to other financial obligations. Many countries charge stamp duties, land transfer taxes, and notary fees on real estate deals. Ongoing expenses, including property taxes, utilities, association dues, and required insurance, can also vary widely. Some destinations mandate annual residency or capital gains taxes that surprise unwary buyers. Thorough budgeting and understanding each recurring expense will shield you from unpleasant surprises after closing. Reliable information about global property taxes can be found at CBS News – Property Taxes.

Engaging Local Experts

Your local support network is invaluable. Partner with reputable realtors, lawyers, notaries, and, when necessary, financial advisors. These professionals are deeply familiar with the local market and regulations, helping you negotiate effectively, manage paperwork, and avoid legal pitfalls. Reliable local expertise ensures your purchase is compliant and your transaction is completed efficiently and ethically.

Evaluating Residency and Visa Requirements

Buying property doesn’t always equal permission to stay indefinitely. Each country has its own approach to foreign property owners regarding residency and visas. Some, like Portugal and Spain, offer “Golden Visa” programs granting residency to those who meet investment thresholds. Others maintain stricter immigration requirements, even for property owners. Understanding these frameworks is vital if you plan to live or stay long-term in your new home. Review country-specific immigration policies before making any buying decision.

Planning for Property Management

If you’re not planning to live at your new property year-round, consider ongoing upkeep and security. Hiring a trusted local property manager can handle routine maintenance, bill payments, and tenant communications if you rent out the space. A reputable property management company will ensure your investment remains protected, occupied, and generates income when you’re absent.

Bottom Line

The reward of owning international real estate can be immense, so long as the process is managed with care, due diligence, and precise knowledge of local laws. Assemble your professional team early, and arm yourself with the correct information. Every step taken with diligence today means less stress and fewer surprises tomorrow, helping you realize your dream of a seamless overseas property purchase with confidence and security.