Table of Contents

Key Takeaways

- Learn how to anticipate and adapt to future changes in the market.

- Explore essential diversification strategies for risk management.

- Discover why embracing technology improves investment resilience.

- Understand the rising importance of ESG and sustainable investing.

- Adopt best practices for monitoring and adjusting your portfolio over time.

Introduction

With unpredictable shifts in global markets, economic cycles, and innovations, safeguarding your investment portfolio for the long haul is more critical than ever. Building a resilient strategy begins with understanding today’s risks and leveraging new opportunities, ensuring your financial well-being stands firm against tomorrow’s uncertainties. Consulting with a seasoned financial planner can provide a tailored approach, aligning your investments with your immediate needs and long-term goals.

Developing a future-proof portfolio goes beyond simple diversification. It means actively preparing for technological shifts, climate challenges, regulatory changes, and market volatility. This article guides you through practical methods to bolster your investments and respond confidently to emerging global trends.

Investors who anticipate change and adapt proactively tend to weather economic storms more successfully than those who react as events unfold. Strategies such as incorporating technological analysis and focusing on sustainable sectors are becoming increasingly crucial. Everyone’s risk tolerance and preference are different, so setting up your plan with a mix of tools and insights is key.

Lastly, your approach should integrate both the art and science of investing. Combining analytical data with a strong understanding of your financial objectives can lead to more brilliant, more resilient positioning. Periodic reviews with professional advisors, including those specializing in retirement planning, ensure your investment roadmap stays current and actionable through each life stage.

Understanding Future-Proofing

Future-proofing your investment portfolio is a deliberate strategy focused on minimizing risk and capturing opportunities before they become obvious to everyone else. Investors can keep their portfolios robust over time by actively anticipating possible disruptions—from new regulations to technological innovations, demographic shifts, or climate risks.

Success in future-proofing comes from blending a vigilant mindset with flexibility. This means staying aware of market signals, understanding historical trends, and continuously adapting to new realities as they emerge. Investors who regularly educate themselves and use the guidance of industry experts tend to outperform those who rely solely on rules of thumb or past performance.

Diversification Strategies

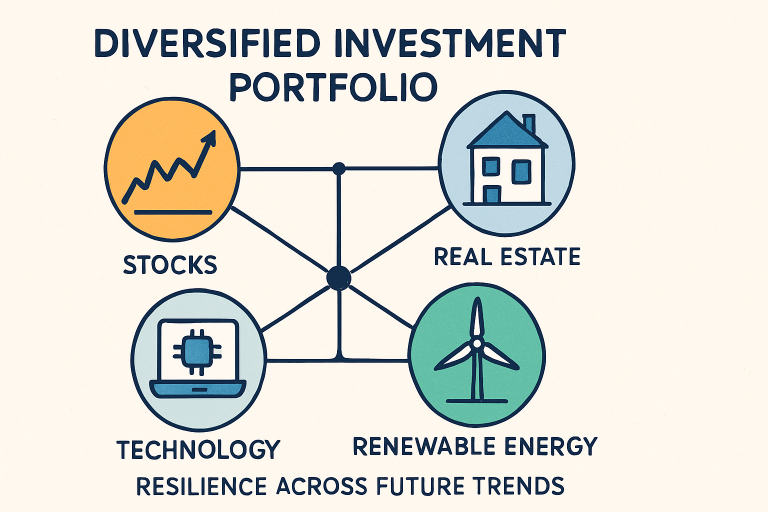

Diversification remains the first line of defense against unpredictable market downturns and sector-specific volatility. Allocating capital across multiple asset classes—such as equities, fixed income, real estate, and even emerging categories like digital assets—helps manage risk exposure. According to Forbes, diversification can increase returns while reducing the overall swings in your portfolio’s value.

Savvy diversification doesn’t end with asset types. Expanding investments across geographic regions and industry sectors can buffer against regional instabilities or industry disruption. Balancing domestic and international exposure ensures that gains in one area may offset declines in another, keeping your net results steady during economic change.

Avoiding Over-Diversification

While spreading risk is beneficial, over-diversification can dilute returns and complicate monitoring efforts. Portfolio reviews with an experienced advisor help ensure you’re maximizing quality over quantity and keeping your strategy aligned with your objectives.

Embracing Technology

Technological innovation now sits at the heart of investment strategy. Advanced analytics, artificial intelligence, and algorithmic trading platforms offer insights previously unattainable to retail investors. Leveraging these technologies enables better risk assessment, more precise forecasting, and automated rebalancing during volatile markets. As reported by CNBC, AI and data-driven tools are transforming how modern investors build and maintain wealth.

Integrating Digital Tools

Robo-advisors, portfolio management apps, and real-time data dashboards make it simpler than ever for investors to react promptly to market shifts. Technology-driven insights not only improve return potential but also help identify systemic risks before they manifest as losses.

Sustainable Investing

Environmental, Social, and Governance (ESG) factors are steadily becoming a mainstream consideration in investment decisions. Companies prioritizing ESG best practices often show more resilience to regulatory upheaval, shifting consumer preferences, and environmental disasters. As outlined in Barron’s, ESG-driven portfolios have begun to outperform traditional ones during market turbulence, highlighting the value of sustainability as a core strategy.

Capitalizing on Megatrends

Large-scale themes such as climate technology, renewable energy, and smart infrastructure present not only ethical rewards but also growing financial opportunities. Early adoption in these areas may provide superior long-term growth while positively impacting society and the planet.

Monitoring and Adjusting

Continuous oversight is critical to maintaining your portfolio’s “future-proof” quality. Market dynamics, tax laws, and personal goals all evolve. Schedule routine portfolio reviews—at least annually or during major life changes—so you can rebalance based on current conditions and updated forecasts.

Staying abreast of economic news, regulatory changes, and international developments ensures you react swiftly to shifts impacting your investments. Many investors also benefit from utilizing automatic alerts or services that track portfolio health and recommend timely adjustments as needed.

Conclusion

Building a future-proof investment portfolio is a dynamic process that doesn’t end after your initial allocation. It requires proactive diversification, embracing technological advancements, prioritizing sustainable investments, and consistently monitoring global trends. By working with experienced professionals and remaining agile in a rapidly changing landscape, you can significantly boost your odds of meeting long-term financial goals, no matter what the future holds.